Go Where You Wanna Go

Newsletter 4: Exit

Should you exclaim that taxes are theft, an often-heard retort is, “you can move”. But can you? A famous book in the context of political migration and Network States is “Voice, Exit, and Loyalty” by Albert Hirschman. It deals with a fundamental question: Do you remain where you are and try to improve the situation through Voice, or do you Exit? This applies to your local grocer, your Netflix subscription, your marriage, and where you reside. When Voice is not sufficiently available, or deemed to have insufficient impact, people may choose Exit. (Or pick some combination of both, as the Free State Project does.)

Most countries (should) wish to attract human and financial capital, and thus compete for individuals that bring such things upon an Exit elsewhere. There are, for this reason, various countries that have special visas and deals to attract foreign talent. (Sometimes in stark contrast to how its regular citizens are treated.) However, a loss of capital and talent is unfortunate for the place whence the individual decides to Exit. A response of the state can then be, as it is of many companies, to ask for a reason for the Exit and to improve the product to retain the customer.

However, another response can simply be to hamstring the person, and to raise their cost of Exit instead of their value in remaining. For instance, by putting up a wall and murdering them should they cross, as was done in the DDR with the Berlin Wall, in a response to many East Germans fleeing to West Germany, where they were welcomed to a better life. Modern Western nation states may also erect virtual walls, such as by imposing a so-called ‘exit tax’, only allowing citizens to leave if they pay the entity that supposedly protects and serves them, or otherwise making it harder, though not quite deadly, for their citizens and their families to escape the boot. It is important for Network States and countries to be able to attract people by offering them, to put it simply, a nicer place to live. As such we’d like them to conveniently move to such places. This week we’ve seen some positive and some negative developments on this theme of mobility, which is the topic of today’s newsletter.

⚡Top of the Agenda

Trump promises to end double taxation for American expats relieving millionaires of Americans from paying for services they do not use.

The UK and the Netherlands are considering making you pay to leave the country with an exit tax.

LEADING STORIES

1. Trump promises to end double taxation for 4.4 million American expats

In a statement made to the Wall Street Journal, Trump promised to end the double taxation of Americans living overseas if he becomes president again.

Under the current US tax policy, Americans are taxed by both their adopted country, and by the US.

His support to end this tax policy did not include specific details about how it would be implemented nor when.

Currently, US citizens can only avoid paying double taxes if the US has a tax treaty with the overseas country they are living in.

The announcement is aimed at the millions of American expatriates who can vote in the 2024 presidential election, but will also likely be important for those thinking of moving overseas in the future.

Republicans Overseas, an advocacy group, secured Trump's support after a decade of lobbying and calls the potential reform "life-changing for millions".

Some history…

Double taxation was first introduced during the American Civil War to prevent wealthy Americans from avoiding their taxes by fleeing to other countries. Some years after the civil war, in 1872, the policy was initially repealed.

In 1913, the modern system of citizenship-based taxation was permanently established with the ratification of the 16th Amendment.

This gave Congress the authority to collect income taxes and allowed the U.S. to tax its citizens' worldwide income.

In 1970, the The Bank Secrecy Act introduced new reporting requirements for foreign financial accounts (FBAR).

More recently, in 2010, the Foreign Account Tax Compliance Act (FATCA) was enacted in order to prevent tax evasion. It requires that foreign financial institutions and US citizens report annually on assets held by them.

FATCA significantly increased the reporting requirements for U.S. citizens with foreign financial accounts and for foreign financial institutions serving U.S. clients.

Notable facts….

Many U.S. citizens living abroad have renounced their citizenship due to tax complications and administrative burdens. Doing so comes with an exit tax.

The U.S. remains one of only two countries (along with Eritrea) that taxes based on citizenship rather than residence.

Qualifying for Foreign Earned Income Exclusion (FEIE) is possible under some conditions; like a tax treaty existing with a country the citizen is living in. It is intended to prevent double taxation.

2. The UK and the Netherlands are considering exit taxes for migrants

Some countries have a problem: its wealthy citizens, who are typically net taxpayers, choose Exit. They do this for various reasons, one of which could be a more favorable tax climate, but they may also do it for the weather.

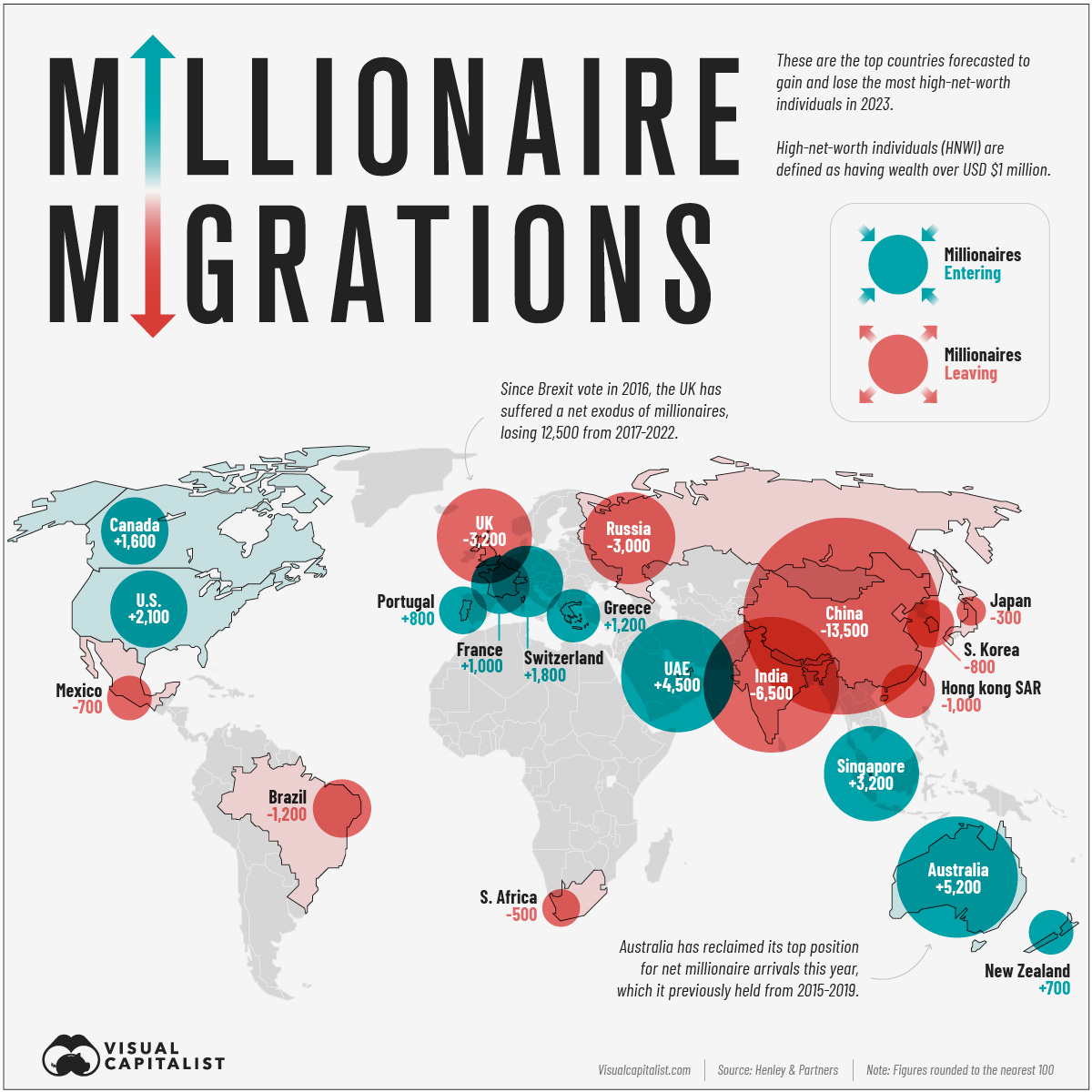

Leavers exit China, India, Russia, and the UK, and enter Dubai, Australia, Singapore. Documented by The Visual Capitalist.

Some countries, such as Portugal, seek to incentivize such individuals to move to their country, with some success.

Others, such as The Netherlands, are now looking to disincentivize wealthy individuals from leaving, (and by definition, from arriving):

This week, the Dutch House of Representatives accepted a motion to look into an Exit Tax for individuals who seek to leave the country. The motion does not say what this tax will be, and does not imply any policy will be enacted, but it does show that there is strong political support to trap net taxpaying citizens.

This is despite the Netherlands, as of 2022, having a net inflow of millionaires.

The UK, which has the largest exodus of wealthy individuals per capita, has also been discussing such a move.

Now, aside from this being a violation of your property rights, it also may not work. Norway tried it, and it is now allegedly losing the country an estimated 594 million per year.

It also comes at a time when Europe is already struggling to remain competitive, as French President Emmanuel Macron and former European Central Bank President Mario Draghi have lamented, the latter calling it an “existential crisis.”

Fortunately, many European countries still have a net inflow of (human) capital. Could Europe attract even more capital, (investments in) innovation, and reverse its crisis?

Other stories

Liberland elects cryptocurrency executive Justin Sun as Prime Minister.

Kraken, one of the last exchanges to still list Monero, the privacy-first cryptocurrency, stops listing it in Europe over regulatory concerns. You are advised to use Cake Wallet instead.

Scott Alexander has written a ‘report-card’ on the progress of Argentina’s President Milei, in which he writes, among other (more positive) things, that although the 4% month-on-month inflation is a great achievement from the top, it’s not historically unusual for Argentina, and still awfully high.

Fortunately, the data are still downtrending, from 4,2% in August to 4% in September.

People on Reddit are unimpressed by Hoppe being unimpressed by Milei. We posted the video where Hoppe criticized Milei in last week’s newsletter.

Interesting Media & Content

Ordinals (NFTs on Bitcoin) & Runes (Shitcoins on Bitcoin) creator Casey Rodarmor discusses various social media platforms for free speech: Nostr, Farcaster, Urbit, Truth Social, and BlueSky, on his podcast Hell Money.

Upcoming Events

Ongoing: The Network School, Near Singapore: September 23 - December 23, 2024.

Zelar City, Berlin, Germany: October 5th - November 17th, 2024

Edge City Lanna, Chang Mai, Thailand: October 10th - November 10th, 2024.

The Network Society Camp, Austin, TX, United States: 11 - 14 October, 2024.

Crypto City Builders - Exploration Program, Próspera ZEDE, Roatán, Honduras: October 19th - November 25th, 2024.

Crypto Cities Summit, Próspera ZEDE, Roatán, Honduras: 26 - 27 October, 2024.

Liberty in Our Lifetime, Prague, Czech Republic: 1 - 3 November, 2024.

Arkham x Praxis Campus, Dominican Republic: 5 - 8 November, 2024.

ZuGarden, Bangkok and an Island in Thailand: 10 - 30 November, 2024.

Adopting Bitcoin, San Salvador, El Salvador: 15 - 16 November, 2024.

Safe Harbor Summit, Vitalia City, Próspera ZEDE, Honduras: 16 - 17 November, 2024.

Vitalia Startup Demo Day, Vitalia City, Próspera ZEDE, Honduras: November 18th, 2024.

Vitalia Forever, Vitalia City, Prospera ZEDE, Honduras: January 6th - March 3rd, 2025.

Edge Esmeralda 2025, Healdsburg, CA, USA: April 24th - June 21st, 2025

See based.guide’s event page for all events.